In this extract from our digital Insight magazine in February, Graham Wood, Head of Products & Partnerships, explores the key trends shaping the mortgage industry, as well as the broader residential and buy-to-let markets.

With Stamp Duty changes coming into effect on 1st April 2025, the market has started to see a jump in transactions in the early stages of 2025. This article offers valuable insights into the challenges and opportunities throughout the mortgage industry.

Market Overview

Throughout 2024, lower inflation, rising real wages and gradual cuts in mortgage rates began to ease the affordability constraints which held back the market in 2023. This led to modest annual growth in lending for house purchases, although remortgage markets remained subdued.

Whilst final figures for 2024 are yet to be finalised, a recent UK Finance report anticipated that gross mortgage lending would finish around £235 billion, which will be a circa 4% increase on 2023.

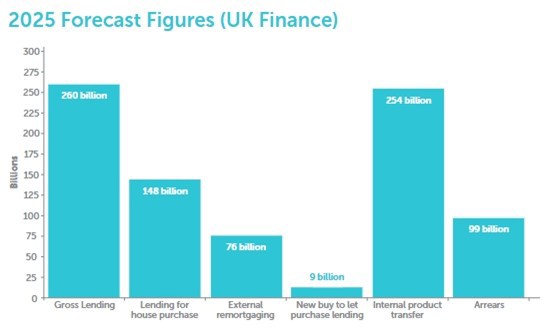

The UK Finance report commented that with rate and cost pressures continuing to ease, in their view the outlook for 2025 is for a gradual improvement in mortgage affordability, feeding into market growth and in turn UK Finance are forecasting gross mortgage lending for 2025 to be £260 billion (see table below), which will be an increase from circa £235bn in 2024. It is also worth noting that it has been reported that circa £140bn of lending will be reaching maturity during the first half of 2025 – £121.9bn in residential and a further £19bn in Buy to Let.

In line with the UK Finance commentary a recent Nationwide report said that they are predicting a house price growth of between 2-4%. The Nationwide report also acknowledged that the upcoming changes to stamp duty may well generate a level of volatility, as buyers bring forward their purchases to avoid the additional tax. This could lead to a jump in transactions in the first three months of 2025 and a corresponding period of weakness in the following three to six months, as occurred in the wake of previous stamp duty changes. This will make it more difficult to predict the underlying strength of the market.

Buy-to-Let Market

Turning to the buy-to-let market, Lloyds Banking Group recently reported that in 2025 the outlook for BTL market looked to be subdued by historical standards, especially compared to the boom of the early 2000s, but it’s in a similar shape and size to how it was looking in 2024. With changes in taxation and additional regulatory scrutiny still to come, the landscape for landlords has become more complex, although the market continues to see the importance of the private rented sector and buy-to-let. All of which is something landlord customers will need the assistance and support of advisers for.

Final Thoughts

In summary, despite some wider market and global challenges, general market commentary would suggest 2025 should be a year of growth and with growth comes opportunity! With increasing complexity in all sectors, the importance the role of an adviser plays to help customers navigate the ever-changing landscape, in both mortgage and protection, continues to be so very important.

Mortgage Intelligence remains committed to ensuring our members have mortgage lenders, protection providers and GI insurers to meet the needs of advisers and their customers.

Not part of Mortgage Intelligence?

To access our bi-monthly digital Insight magazine, for updates on industry trends, market insights and practical tips to develop your business, join Mortgage Intelligence.