This is an excerpt from our April edition of Insight. In a macroeconomic roundup, we explore the impact of inflation, economic growth, employment and demand on the mortgage industry.

To access our bi-monthly Insight content for updates on industry trends, market insights and practical tips to develop your business, join Mortgage Intelligence.

The mortgage industry continues to face a complex and evolving economic landscape as we move through 2025. Chancellor Rachel Reeves’ recent Spring Statement provided insight into the government’s fiscal strategy and economic outlook. Inflationary pressures, slow economic growth, and shifting employment dynamics all play a role in shaping the mortgage industry and consumption trends for the year ahead.

Inflation: A Slow Descent

Inflation remains a critical concern, though the situation has shown some improvement. As of April 2025, inflation has fallen to 2.6%, down from 2.8% in February and 3% in January. This decline provides some relief to households, but inflation remains above the Bank of England’s 2% target. More concerningly, the months ahead may see renewed inflationary pressure due to rising council tax bills, energy costs, and wage demands. While the Bank of England has responded by cutting the Bank Rate three times since August 2024, it opted to hold at 4.5% in March due to ongoing trade uncertainty and wage pressures.

While borrowing costs are lower than in mid-2024, any further rate cuts will likely be slow and measured. This environment presents a mixed picture: while affordability may improve slightly for some borrowers, continued cost-of-living challenges may impact demand throughout the mortgage industry.

Economic Growth: Recovery Ahead

Economic stagnation continues to be a pressing issue. 2024 ended on a disappointing note, and while moderate improvements are expected, growth remains sluggish. The Office for Budget Responsibility (OBR) has revised its 2025 growth forecast down to 1% from an earlier projection of 2%. Stagflation, where inflation remains above target while economic expansion is weak, continues to be a concern.

However, there are signs of hope. Consumer spending grew by 0.6% in the second half of 2024, and this, combined with increased government spending, is expected to support growth through 2025. By 2026, the economy is expected to grow at 1.9%, with further moderate improvements in the following years.

For the mortgage industry, weak economic growth may limit the number of new borrowers entering the market, particularly first-time buyers. On the other hand, improved consumer spending and anticipated wage increases could provide a counterbalance, supporting demand for refinancing and home purchases among existing homeowners.

Employment & Household Finances

The labour market remains under pressure, with 2.8 million people economically inactive due to ill health. One in ten working-age individuals now claims incapacity or disability benefits, a figure that has grown significantly since the pandemic.

Despite these challenges, wages and household disposable income are expected to rise over the coming years. The OBR forecasts that wages will increase by 2.2%, while household disposable income per capita is set to grow by 2.6% over this Parliament (Q3 2024 – Q2 2029). However, the effects of welfare reforms may be uneven. While 3.8 million families are expected to be financially better off by an average of £420 per year after adjusting for inflation, 3.2 million families are projected to lose an average of £1,720 annually. Some households will have increased purchasing power and others will face financial constraints, potentially reducing their ability to buy a home or remortgage on favourable terms.

Housebuilding & Mortgage Demand

The government’s push to accelerate housebuilding is one of the most significant developments for the mortgage industry. The Spring Statement outlined an additional £2 billion in funding for social and affordable housing in 2026-27, aligning with plans to build 1.5 million homes over the Parliament’s term. December 2024 saw major reforms to the National Planning Policy Framework (NPPF), reintroducing mandatory housing targets and revising Green Belt policies to enable more development on low-quality land.

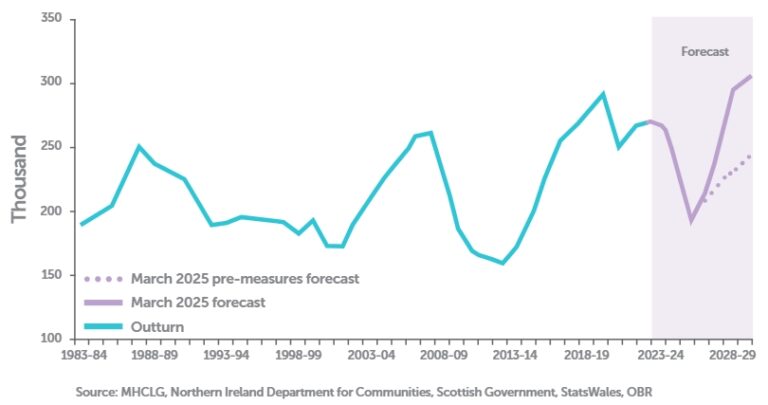

These measures are expected to have a significant impact. The OBR estimates that planning reforms will increase annual housebuilding by 30% by 2029-30, pushing net additions to a 40-year high and delivering an additional 170,000 homes. The overall housing stock is projected to reach 305,000 net additions per year by the end of the decade. Increased housing supply could help stabilise house prices, making homeownership more attainable for prospective buyers.

(Net Additions to the UK Housing Stock, OBR 2025)

Despite these long-term improvements, the immediate outlook for the mortgage market remains uncertain. Interest rates are expected to decline slowly, with affordability constraints persisting for many households. Average house prices rose by 4.9% in the 12 months to January 2025, reaching £269,000 overall and £291,000 in England. While price growth remains positive, an influx of new housing supply over the coming years may ease further increases.

The OBR expects the average interest rates on mortgages to rise from 3.7% in 2024 to a peak of 4.7% in 2028, remaining at that level until the end of the forecast. The high proportion (around 85%) of fixed-rate mortgages means increases in Bank Rate will feed slowly into the mortgage stock. An estimate by the Bank of England states that one-third of those on fixed rate mortgages have not refixed since rates started to rise in mid-2021, so the full impact of higher interest rates has not yet been passed on.

This presents a landscape of both opportunity and challenge within the mortgage industry. On one hand, increased housing supply and lower borrowing costs could attract more buyers into the market. On the other hand, affordability concerns and economic uncertainty may limit mortgage demand in the near term.